Background

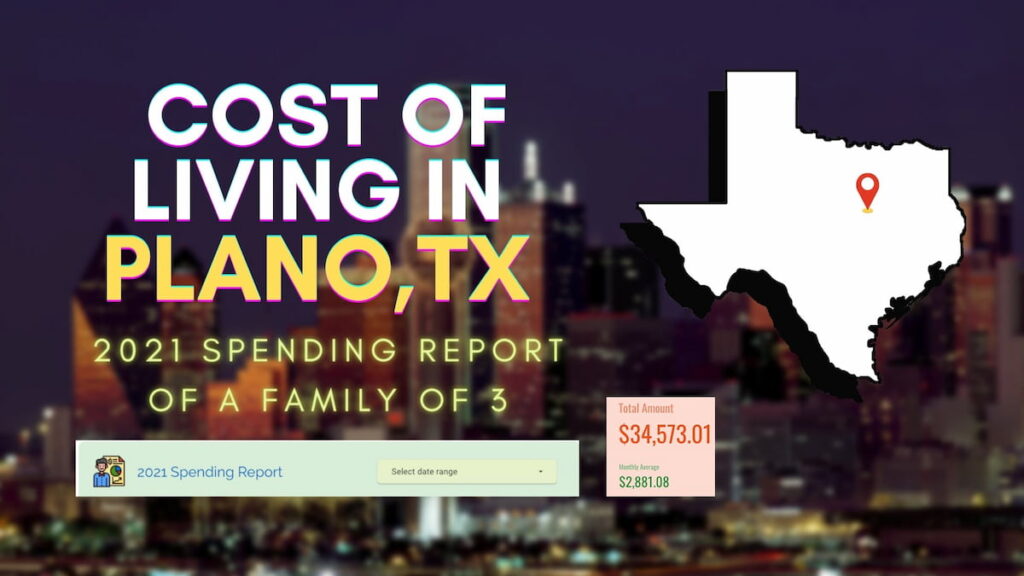

2021 was different to all of us in so many ways, most of us adjusted to new ways of living, started new hobbies, and learned new skills, and so did I.

I started 2021 with one financial goal to track all my expenses (literally every penny), and I did.

I used Google Sheets to track my expenses and entered more than 1000 rows throughout the year. Use below interactive report I created using google data studio for in-depth analysis. Yes, it’s interactive.

“The Compound Effect is the principle of reaping huge rewards from a series of small, smart choices.”

Darren Hardy, The Compound Effect Tweet

Considerations for the report

Before you jump into the actual report, here are some of the things I considered keeping and excluding from the report.

Included in the report

We are family of 3 (includes our toddler)

We lived in the same area for over an year, Plano, Tx, (75024).

We were renting 2-bedroom apartment.

Report includes basic needs for the family and I have excluded any personal expenses.

Excluded from the report

Excluded both Health and Car insurance from the report as they tend to vary for all. For example, I was paying around $50 for my car insurance with only liability coverage.

As I was working from home, fuel cost was less and it can vary based on how far you live from your office.

Excluded all the personal expenses of shopping.

Daycares are personal choice, on average you will pay around $900 to $1000 in Plano.

2021 Spending Report

Use this interactive report to drill down into more details.

5 key findings from 2021 spending

Visualizing your money habits could reveal fun things about your money behavior. Here are my 5 best findings from the report.

-

1. Monthly Average Spending $2881

Cost of living is expensive in Plano. With other family needs one must plan to keep at $4000 for family expenses. This gives me better idea how much should I keep aside for 2022.

-

2. Sam's Club made the most money from us $1951.45

Select Store: Sams for more analysis.

-

3. Expected Expenses in Unexpected Month $745

I know I had to change tires on the car but I wasn't expecting in 2021. September month went up to fix that.

-

4. Average monthly expense for food $566.24

Select Category of 'Eating Out' and 'Groceries'. For the family of 3 we spent $6794.87 in total on food.

-

5. We tried to eat healthy when eating out $461.55

Choose Category of Eating Out for more detailed analysis.

Tools I used for creating the report

If you are interested in creating insightful reports for yourself then you can start with these FREE tools.

- Google Sheets: Create a simple spreadsheet with your needs

- Google Data Studio: Add your spreadsheet to the data studio and start analyzing.

- Time: I spent probably 5-10 mins each night adding the daily expenses

Conclusion

The cost of living in Plano is high. With a lot of people trying to make Plano their new home city, it’s growing rapidly, and things are getting even costlier.

I started 2021 with one goal of understanding how much my family would need to survive in Plano and the report above is the result of that goal.

Our spending from 2021 will definitely help us to make sure we have enough planned for the 2022 budget.

Tracking expenses has been the best financial habit I mastered in 2021 for it helped me gain hold of where my money is going.

I was hugely influenced by the book “The Compounding Effect” by Darren Hardy, where he talks about the benefits of tracking anything or everything that compounds over time towards your goals.

You can buy the book here and learn about the power of compounding.