Unlock Your Freedom: A Guide to Using the Financial Independence Retire Early Calculator, FIRE Calculator- FIREcalc (25x Rule) 🧮

If you’re striving for a life where you have complete control over your schedule—free of the 9-to-5 grind—then you may need some help to navigate your financial. In this article, we delve into the simplicity, functionality, and power of the Financial Independence Retire Early (FIRE) Calculator—a tool that could be the compass to your monetary freedom.

And your trusty guide to unlock this door? The FIRE Calculator (25x Rule).

What is the 25x Rule? 🤔

This simple yet powerful formula estimates your path to FIRE. Here’s the essence: Multiply your annual spending by 25. That magic number becomes your “target nest egg” – the amount you need invested to generate enough passive income to cover your expenses, forever. This is your ticket to freedom.

🔥Why 25?

Let’s say you invest your nest egg in a diversified portfolio earning a conservative 4% annual return. With the 25x rule, that passive income (4% of your nest egg) equals your annual spending. Voila! You’ve officially retired early, living off your investments, not your paycheck.

Historically stock market has returned more 10% (source: Investopedia) which is way over 4% withdrawl assumption keeping rest to grow. The farmula works if your money is invested in stock for long-term.

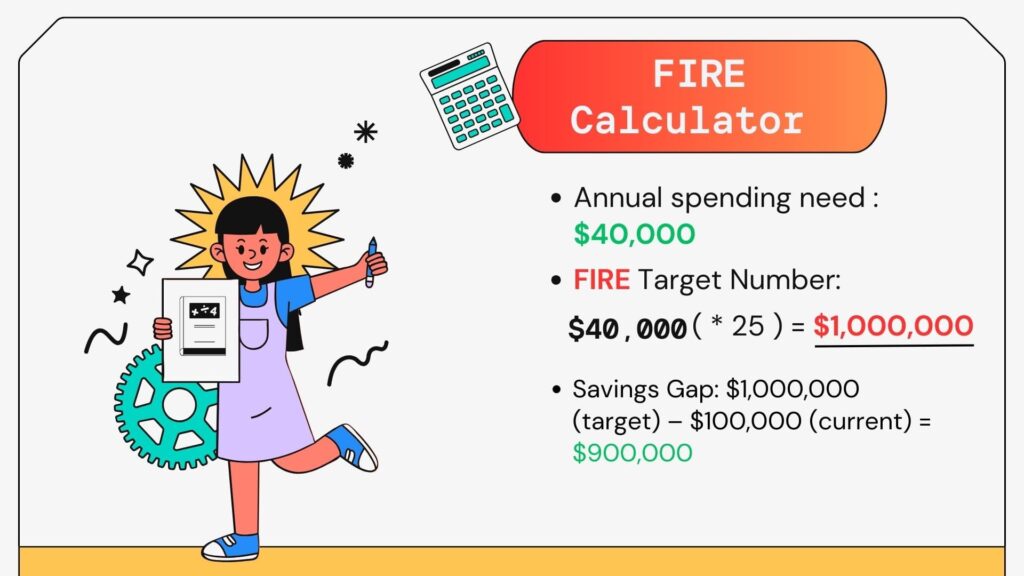

Step-by-Step Calculation Example 🪜

Meet Sarah: Age 30, her annual spending is $40,000.

- FIRE Target Nest Egg: $40,000 (spending) * 25 = $1,000,000.

- Investment Required: This depends on your current savings and future contributions. Let’s say Sarah has $100,000.

- Savings Gap: $1,000,000 (target) – $100,000 (current) = $900,000

"FIRE is not just a financial strategy. It’s a lifestyle that promotes living for the moment while planning for the future."

- A man on 🔥 Tweet

Now, the real journey begins. 🔰

Boosting Your FIRE Power:

- Increase Savings Rate: Sarah can save $15,000/month to bridge the gap in 6 years. Every extra dollar saved brings her closer to freedom.

- Reduce Expenses: Can Sarah ditch cable? Cook more meals at home? Downsize living? Every expense trimmed adds fuel to the FIRE rocket.

- Maximize Investment Returns: While safe bets like bonds appeal, diversified stocks offer slightly higher long-term returns. Sarah can consult a financial advisor for a personalized mix.

Remember, the 25x rule is a guideline, not a rigid rulebook. Adjust it to your unique circumstances and risk tolerance. Life throws curveballs, so factor in flexibility. The key is to start planning, track progress, and keep the FIRE burning.

The FIRE Calculator Advantage:

Online FIRE calculators automate the 25x formula, adding features like inflation adjustments and historical investment data. Popular options include Networthify and Mr. Money Mustache’s calculator. These tools offer a dynamic view of your FIRE journey, helping you refine your strategy and stay motivated.

🔥 Beyond the Numbers:

FIRE isn’t just about spreadsheets and numbers. It’s about reclaiming your time, pursuing passions, and creating a life truly yours. Imagine writing novels on sun-drenched beaches, volunteering for causes you care about, or simply savoring life without deadlines looming. The 25x rule is the map, but the destination is a life unbound, brimming with possibilities.

So, fire up your FIRE calculator, take the first step, and watch your path to freedom illuminate. Remember, with a bit of planning, perseverance, and the 25x rule as your compass, you’re just a few calculated decisions away from unlocking your own version of paradise.

Wrapping Up: Charting a Confident Course towards FIRE 🔥

The journey to financial independence and early retirement is an ambitious one. It requires determination, resilience, and careful planning – and it’s different for everybody. Harness the power of the FIRECalc to map your path and remember, it’s not a one-size-fits-all solution.

Armed with this knowledge, you’re prepared to wave goodbye to the proverbial rat race, shaping your financial future with confidence.

"Financial independence is about having more choices."

- Robert Kiyosaki Tweet

Be patient, have confidence in your calculations, and leave the worry behind. The freedom of your financial future awaits!

What's Next: take action today 🎯

- Learn More about FIRE: Embracing Fire Financial Independence Retire Early: A New Approach to Life

- Start Budgeting: Decoding the Perfect Budget: Know How Much to Save Each Month

- Learn Why you must think about money: Best Books for Financial Education