Breaking Free from Financial Frustration: 5 Financial Resolutions for the New Year 🎯

Ever found yourself just days into the New Year, wrestling with the same old financial demons while your newly minted resolutions sit collecting dust? Getting your finances in order is a resolution often put on the back burner.

However, a new year offers the perfect opportunity for a new start. In this article, we’ll explore five financial resolutions that, if followed, can turn your monetary muse into a material marvel.

1. Budgeting: A Blueprint for Success✅

Budgeting can often feel like a chore. However, consider it the blueprint for your financial castle that you’re striving to build.

📌 Start with a Budget

- 🎯Review your income versus expenses.

- 🎯Identify non-essential expenses.

- 🎯Set goals for saving, investing, and reducing debt.

Understand that your money is a tool. Ensuring each dollar has a purpose helps to minimize unnecessary spending and maximize your financial potential [1].

"Budgeting isn't about limiting yourself – it's about making the things that excite you possible."

- A thought to remember Tweet

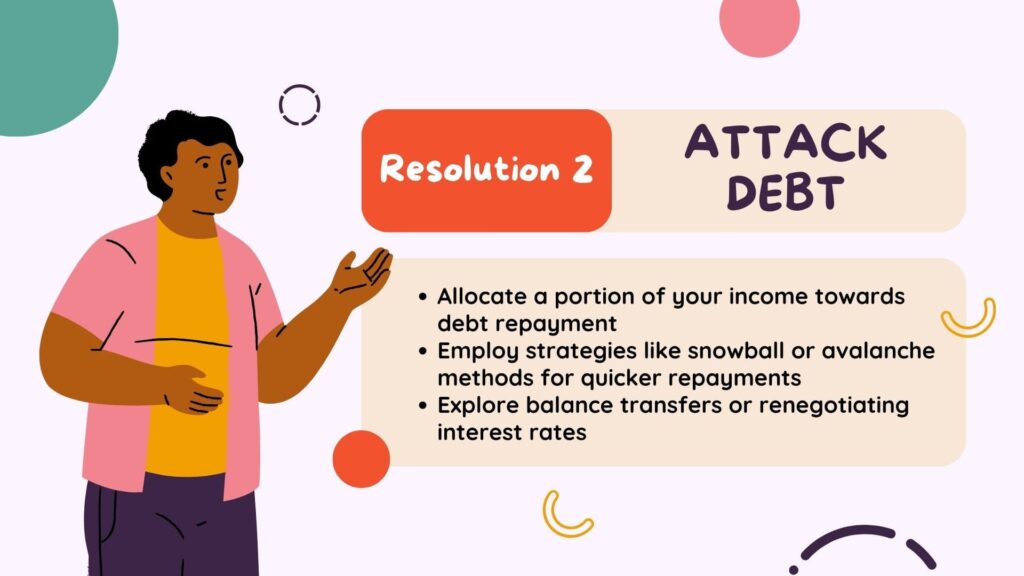

2. Decapitalize Your Debt ✅

Credit card debt, student loans, car loans–they all add up. This year, make a resolution to declutter your debt.

📌 Devise a Debt Reduction Strategy

- 🎯Allocate a portion of your income towards debt repayment

- 🎯Employ strategies like snowball or avalanche methods for quicker repayments [2]

- 🎯Explore balance transfers or renegotiating interest rates

Imagine the relief and financial freedom you’ll experience when these debts are off your ledger.

"If you wouldn't want your kids to have your habits, why would you want them?"

- A thought to remember Tweet

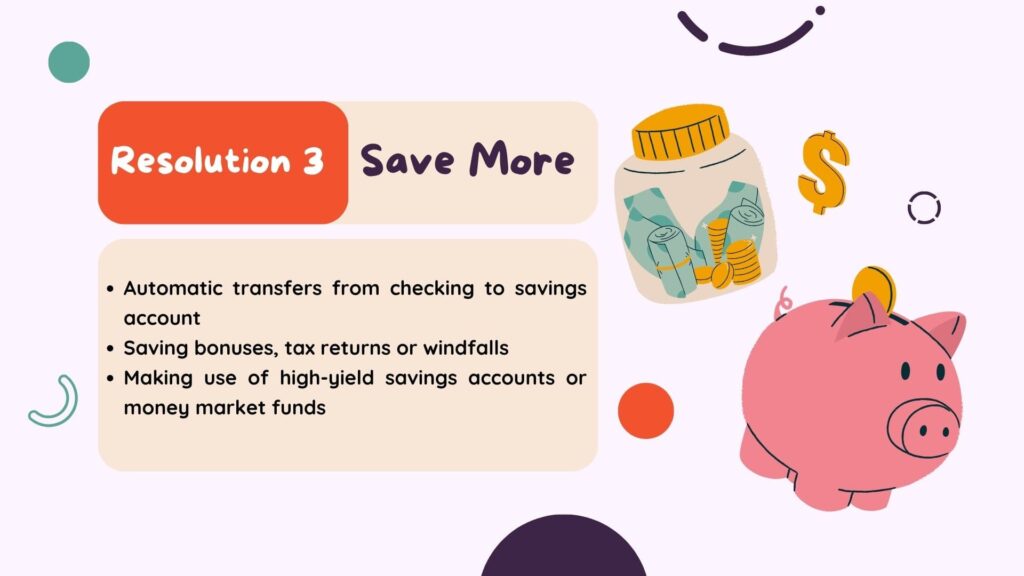

3. Maximize Your Savings ✅

Remember that a penny saved is indeed a penny earned. One of your key financial resolutions should focus on building a robust savings account.

📌 Strategies to Boost Savings

- 🎯Automatic transfers from checking to savings account.

- 🎯Saving bonuses, tax returns or windfalls.

- 🎯Making use of high-yield savings accounts or money market funds [3].

"The habit of saving is itself an education; it fosters every virtue, teaches self-denial, cultivates the sense of order, trains to forethought, and so broadens the mind."

- T.T. Munger Tweet

4. Invest for a Prosperous Future✅

Investing might seem intimidating at first, especially with market volatility. However, the right investments can offer financial peace down the road.

📌 Making Sense of Investments

- 🎯Understand different investment options–stocks, bonds, mutual funds, real estate, etc.

- 🎯Diversify your portfolio.

- 🎯Invest in low-cost index funds or ETFs for beginners [4]

"Investment is most successful when it is not treated as a game at all."

- Warren Buffett Tweet

5. Safeguard Your Financial Future ✅

Life is unpredictable. Therefore, having suitable insurance cover can help safeguard your hard-earned wealth.

📌 Insurance is a Must

- 🎯Evaluate your insurance requirements–life, health, home, auto, etc.

- 🎯Choose policies that cater to your needs.

- 🎯Be sure to periodically review your coverages.

"Insurance is the best gamble you can make. You pay a little now to avoid a big loss later."

- Blaise Pascal Tweet

Conclusion🏁

In summary, preparing financially for the New Year isn’t only about making ends meet. It’s about laying a foundation for a financially sustainable future. By adopting these resolutions, you’re building a compass to guide you towards achieving your economic goals.

Ring in the New Year with financial freedom! Let 2024 be the year you conquer your debt, boost your savings, and invest in your dreams. Make it happen!

"Don't just set goals, set systems in place to achieve them."

- James Clear Tweet