Redesigning Life's Blueprint: Fire Financial Independence Retire Early Method 📚

Everybody talks about chasing dreams, but what if the chase could end sooner than expected? What if there was an approach that lets you attain financial independence and retire early to live the life you always dreamed of? Let’s talk about Fire Financial Independence, retire Early (FIRE) method – a unique perspective that’s turning traditional retirement planning on its head.

In this post, we’ll explore what the FIRE method is, its benefits, and how you can incorporate this strategy into your lifestyle to achieve financial independence.

Embracing the FIRE Method: A Paradigm Shift 🔥

🔥The Basics of FIRE

FIRE is a movement that grew out of the financial crisis of 2008, aimed at achieving financial stability and retiring early. The idea is simple: save significantly more than traditional planning advises, invest wisely, and retire far ahead of the typical age.

- Live frugally

- Save a large portion of income (50-70%)

- Invest wisely to grow wealth

Success stories of people who started in their early 20s and are now financially independent in their 30s or 40s inspire many to embrace this approach.

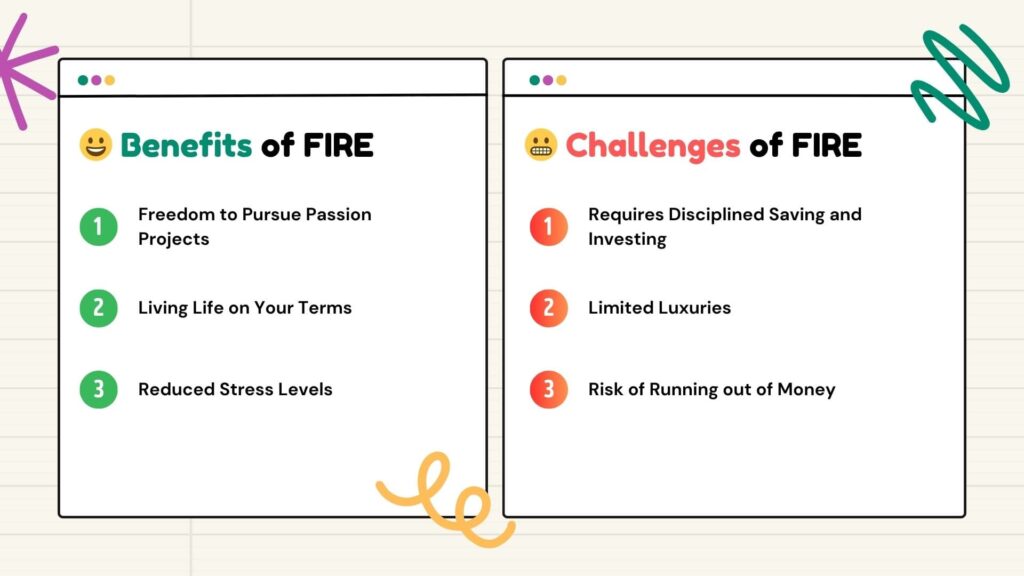

🔥Benefits of FIRE

- Freedom to Pursue Passion Projects: With financial independence, the world is your oyster. You can focus on your interests and hobbies that might not generate significant income.

- Living Life on Your Terms: You decide your everyday activities, explore new hobbies, spend more time with loved ones, and control where and how you live.

- Reduced Stress Levels: Without the pressure of a traditional job, your stress levels can dramatically decrease.

🔥Challenges of FIRE

Let’s be candid here. Achieving FIRE is not a walk in the park.

- Requires Disciplined Saving and Investing: You need to consistently save a large percentage of your income, upwards of 50% in many cases.

- Limited Luxuries: Achieving FIRE may require aggressive cost-cutting which could mean less dining out, fewer vacations, and generally fewer luxuries.

- Risk of Running out of Money: Critical events like serious health issues or global economic upheaval can deplete your savings faster than you expect.

Advantages of the FIRE Method🌟

Let’s dive more into advantages of choosing FIRE. Besides escaping the nine-to-five grind, the FIRE method offers other interesting perks.

🔥Freedom and Flexibility

Your time becomes entirely yours. Whether it’s a hobby, passion project, or simply spending more time with family and friends, FIRE provides the freedom to do what you love.

🔥Greater Stress Control

No more worrying over job security, paying bills, or unexpected financial emergencies. The financial independence resulting from FIRE allows you to reduce stress levels significantly.

🔥Personal Growth

The journey to FIRE requires discipline, planning, and learning new financial concepts – habits that can spur immense personal growth.

"FIRE is not just a financial strategy. It’s a lifestyle that promotes living for the moment while planning for the future."

- A man on 🔥 Tweet

Choose Your FIRE Flavor ✅

The wonderful thing about the FIRE movement is that it’s not a one-size-fits-all approach. You can mold it to fit your circumstances and goals.

- Lean FIRE: Extreme frugality with simple lifestyle, lower retirement income

- Fat FIRE: Upscale lifestyle, higher retirement income

- Coast FIRE: Saving early and then letting investments grow, without additional contribution

Deciding your FIRE flavor could be the first step towards crafting your financial roadmap.

FIRE-ing Up Your Life: The How-To 🤔

🔥 Saving and Budgeting

Track your income and expenses meticulously. Adopt a minimalist lifestyle, focusing on needs rather than wants. Automating your savings can also prevent deviations from your financial targets.

👉 Start here : Decoding the Perfect Budget: Know How Much to Save Each Month

🔥 Smart Investments

Investing is an essential part of FIRE. Diversify your portfolio and make educated investment decisions – be it real estate, stocks, or bonds.

👉 Start here: The Blueprint of Wealth: How to Become a Millionaire with Smart Investing

🔥 Continuous Learning

Stay updated with financial trends and concepts. Use resources like books, blogs, podcasts, and discussion boards to keep learning.

👉 Start here: Best Books for Financial Education

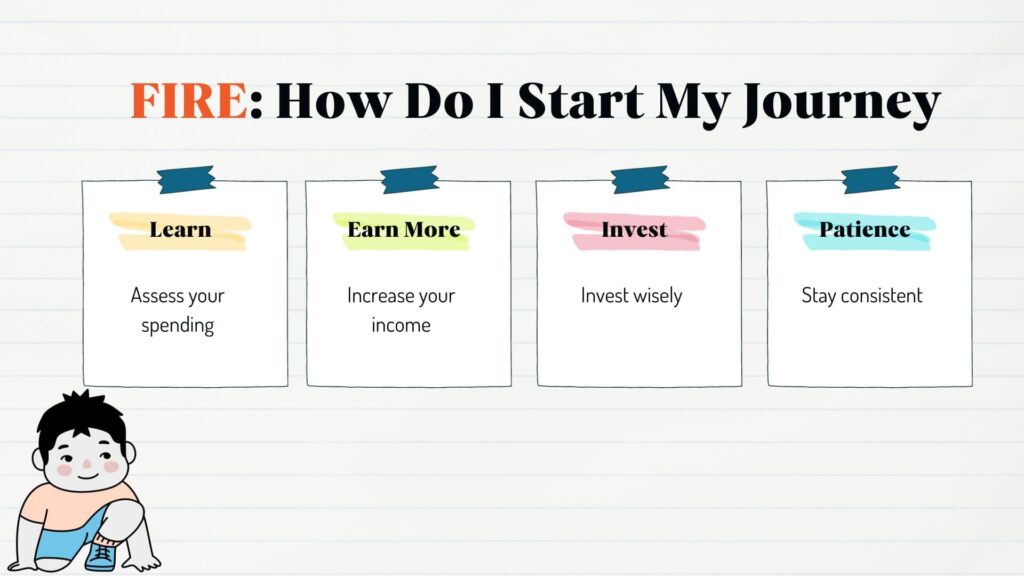

Embracing FIRE: How Do I Start My Journey? 🎒

Feeling that tinge of excitement to start your FIRE journey? Here’s how to kick it off:

- Assess your spending. Figure out where your money is going and see where you can cut costs.

- Increase your income. This could be through side gigs, investing, or asking for a raise.

- Invest wisely. Long-term, low-cost index funds are often recommended.

- Stay consistent. Stay committed to your goals, even when it gets tough.

Conclusion: Ignite Your FIRE Journey Now! ⚡

The FIRE movement isn’t for everyone, but for those willing to make short-term sacrifices for long-term freedom, it’s surely an appealing option. As we wrap up, consider this – Is 40 years of an unsatisfying job worth more than potentially 40+ years of living life on your terms?

“The purpose of our lives is to be happy.”

- Dalai Lama Tweet

Find the spark that works for you and start carving out the path that will lead you to your unique version of happiness.

Embarking on the FIRE journey might require sacrifices and tough choices, but isn’t the prospect of crafting a lifestyle by your terms worth it? So, are you ready to experiment with the FIRE method and redesign your life’s blueprint?

"The ultimate goal is not just financial independence or early retirement; it's living a life true to one's self."

- A Wise Man Tweet

Note: Although we mentioned some investment strategies, you should do your research or work with a financial advisor to decide the best approach for your needs. Financial independence is different for everyone, and it’s essential to find YOUR version of FIRE.

Are you ready to light up your journey towards Financial Independence and Retire Early? The next step is yours to take!