Find where your money is going?

“Where the hell is all my money going?” The most dreaded question I used to ask myself every month end. I used to live paycheck to paycheck with no tracking of my spendings. I hadn’t looked at my money management habits and where did it get me, DEBTS.

At the end of 2018, I lost my job and I wasn’t prepared. My poor money management skills had put me on the spot where I had no options but to sell what I owned and borrow money from friends to start back. I had been working for 7 years and still had almost no money, HOW, and WHY?

To answer those questions, I did what most of us would do, blame the system, blame my closed ones, basically try blaming anyone or anything. But the real problem was ME, the person who had no financial knowledge, the person who did not know how the money works, the person who thought he will have a paying job forever.

- Believing that I will have a paying Job forever

- No Financial Knowledge

- No knowledge of how to manage money

I learned the hard way, life had slapped me hard to make me realize that I had to change my relationship with the money. Money is just a tool that helps us live life happily. Money isn’t everything but one of the major parts which help us enhance our standards of living.

The year 2019, was the year I started from debts, read many books on personal finances, went through my bad habits of managing money and I learned that how little I knew about investing, saving, preparing for emergencies and much more.

The year 2020, I have a job now, paid off my debts, I bought a car and paid it off in one year. I am debt-free. I still read books on personal finances and make sure that I don’t fall into the trap of consumerism.

Learning from those books and countless videos on personal finances, I have found one similar theme and that is one must know where their money is going. I can assure you from my personal experience that it is the most important and the very first thing one must do when starting to manage personal finances.

When I started looking at where my money is going every month, I discovered my habits of handling money. No wonder most of my money habits were not good which was the reason I had no money when I lost the job. Learning from mistakes, I started distributing my money even before I could spend it on anything.

At the start of 2020, every month end I would sit and look at where my money was going. Doing that repetitively, I came up with a money flow diagram to visualize where my money goes.

Before I jump on to the money flow diagram, let me explain what are data flow diagrams.

I am an IT engineer, we use data flow diagrams, to show the clients, how the data flows from one system to another, and what decisions are made and processes are required for the data to be moved. Data flow diagrams are helpful to visualize how data flows in your entire system.

I had trouble visualizing my money flow pattern and I thought why not use a data flow diagram to show where my money goes every month. (Money would be my data in this case.)

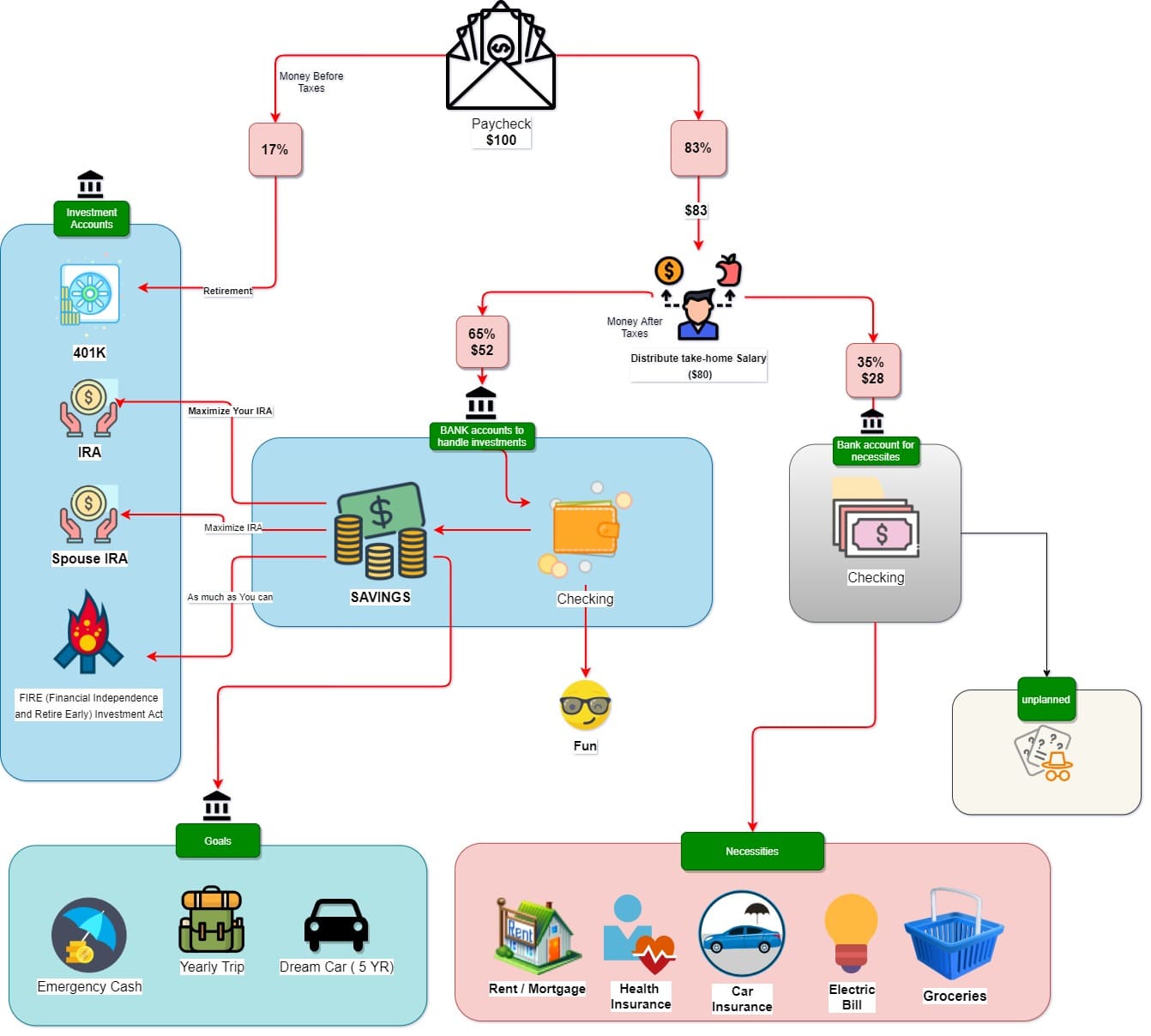

Money Flow Diagram shows how your money flows from the time you receive your paycheck, save for your retirement, spend on necessities, and more.

This is my personal money flow diagram, where my money goes every month. Yes I have not put the exact dollars in there but you get the idea.

“A picture is worth a thousand words.” The money flow Diagram has helped me visualize where my money is and goes every month. Here are my reasons why I came up with the money flow diagram.

- Visualize and get a sense where my money IS and GOING

- While creating this I had to decide how much I value my retirement

- I know exactly how much money I must put aside for retiring early

- I know exactly how much money I need for my necessities

- I know exactly how much I can afford to spend for fun

- I feel safe that I have money put aside for emergencies

- When the time comes to adjust the balances, I know where to adjust

- I feel secure and not stressed that I don’t have to manage 10-15 credit cards or banks

- Easier for me to share with my spouse and family, easier to explain and get everyone on board

Another reason that created a money flow diagram is to have fewer calculations done in my mind every time I get my salary. If that sounds good and you want to create your own money flow diagram start here.

The advantage we all have in the IT era, we can do anything and everything for free online (Pun Intended). I found this website https://app.diagrams.net/ tool to create data flow diagrams and I am amazed by the capabilities they have built-in. I still wonder sometimes how can this all be FREE.

To give my fair share, I am going to attach my money flow template here. Download it for FREE and you don’t have to spend time coming with your own.

- Download the template above

- Go to https://app.diagrams.net/

- Chose ‘Open Existing Diagram’

- Chose the downloaded template

- Start adding your details

- You can export your flow in various formats

“Money is a great servant but a bad master.”– Francis Bacon

Life had to smack me in the face to make me realize that Bacon was true. After losing my job and having debts to cover, I understood that I was handling the money poorly. My mistakes and learnings have taught me mountains.

One of those learnings was to see where my money is and how should I distribute it even before I can afford to spend. To track, visualize, and simplify my personal finances I used the data flow diagrams. We can call it a money flow diagram.

You don’t have to go through hardship to understand the power of money. Create your money flow diagram to manage your personal finances. All you need is a couple of hours, honest answers to yourself, and FREE tools available online.

Share your thoughts on how important money is to you, if you ever had to sit down, figure out where is your money at, and how do you think money must be managed.

2 thoughts on “How to manage your personal finances?”

Lesser Credit cards is the key. Lesser accounts and target driven spending makes life easier.

I really like how you distribute incoming and outgoing amounts.

Appreciate it Atul.

Yes distributing your money before you can spend it will help you keep more of your money.