Why Financial Education is a Must?

“Money is the root of all evil”. Americans owe almost $1 trillion dollars in credit card debt (NPR link), sadly I and you contribute it to this number too. I know what a terrible way to start a conversation but it’s the harsh reality of the world we live in. But why is that?

We were taught in schools to get good marks, get a good job, earn money, and all our problems would be solved. Then why most of us still struggle with money? Why weren’t we educated on how to save, invest, and spend money?

Unfortunately, one can’t even afford a good education without getting into a student loan. If the education system has been created for us all to be responsible members of a better society then why financial education is excluded from it.

Every decision we make or had been made for us is somehow connected to the money. Right from birth (choosing a hospital we can afford for a child’s birth) till death. Then why do we feel bad talking about money? Why do we judge each other based on their paycheck?

If you ever had money problems, If you ever questioned why money holds this enormous power of breaking or making you as a person then you must get financial education.

Why should you Read Books on Money?

- If you just started a job and don’t know how to manage your money

- If you have some kind of debt (student loan, credit card debt, )

- If you think investing is hard

- If you think you need a job until you retire

- If you want to retire early

- If you don’t want money to drive your life

- If you want to get out of the Rat Race of earning more and more

- If you want true FREEDOM

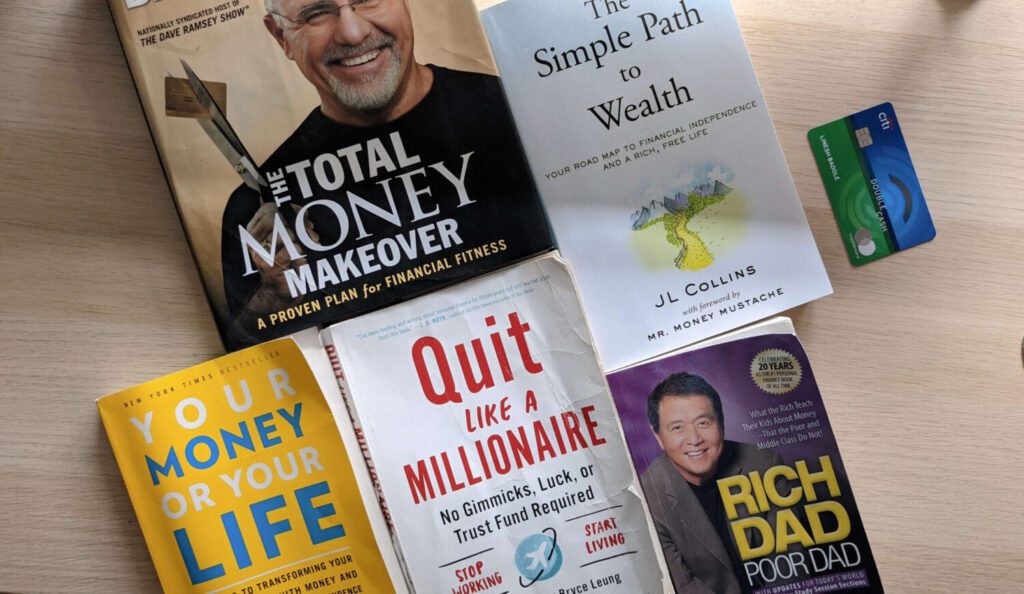

best Books for Financial Education and financial Freedom

1. Rich Dad Poor Dad

What will you Learn

- What’s the difference between being wealthy and being rich?

- Why earning more money will not solve your problems?

- Why your high education and successful profession is not enough without financial literacy?

- What’s the difference between assets and liabilities? How buying assets can make you reach?

- How the fear of losing money and greed to have more keeps us poor and unhappy.

- How financial decisions (small and big) are influenced by our emotions, like buying a fancy dress to purchasing a car and house.

- Why your house might not be an asset.

- Four areas to make your money work, Accounting, Investing, understanding the Market, and Laws.

- How simple math and common sense make you rich.

- Learn to manage fear and risks to get over the pain of losing money

2. The Total Money Makeover

What will you Learn

- If you are in debt and not sure what to do then this book is a must.

- Why the person in the mirror is the cause of your money problems, worries, and shortages

- How winning money are 80 percent behavior and 20 percent financial knowledge

- The want’s of today even before you can afford is living in DEBT, and debt is not a way of living.

- How following what rich people do can make you rich, exactly like doing what physically fit people do can make you physically fit

- You are the only one who is in charge of your retirement, and you must start NOW

- You must have a budget and retirement plan

- Admit that we don’t know anything about money because we were never taught

- 7 Baby steps for financial freedom

- Save $1000 for Emergencies

- Pay all your debt (How debt snowball method works)

- Finish Emergency Fund (At least 3 to 6 months of expenses)

- Invest 15 Percent of your income in retirement

- Save for Education

- Pay off your home mortgage

- Build wealth

3. The Simple Path to Wealth

What will you Learn

- What is investing after all?

- What is “F-You” Money? and how to find how much is needed for yours?

- Why stock-market is the most powerful wealth-building tool of all time.

- Why you must start investing now and not regret it later. Time is literal money.

- Change your thinking from what money can buy to what your money can earn

- How can you retire with 4% of your investment returns and be financially independent?

- Why you shouldn’t worry about a market crash and how the market goes up always, ALWAYS.

- How can you keep your investment portfolio simple with low index funds?

- Which index funds you should buy based on your age?

- You don’t need an investor, how can you balance your portfolio.

- What do when you actually retire?

- What are stocks, bonds?

- How can you simplify your investment even more with TRFs (Target Retirement Funds)?

- Which accounts (401k, HSA, IRA) you should invest in? And how much?

4. Quit like A Millionaire

What will you Learn

- How being in debt gives someone power over you.

- How credit cards can make you forget how precious money is.

- You can’t rely on your company or government for your retirement.

- How shopping can be an addiction?

- The more stuff you add, the more unhappy and stressed you get

- How possessing expensive things will keep you worried.

- Budgeting isn’t about cutting expenses but knowing where your money is going

- Why Index fund work?

- How can you prepare and survive market crashes?

- How can you design your investment portfolios?

- How to grow money tax-free?

- How back-door ROTH IRA works?

- How much you should invest in different investment accounts?

- How can you use your accounts for early retirement?

- How traveling can save you a lot of money? And potentially change your lifestyle?

- What to do after you actually retire?

5. Your Money or your Life

What will you Learn

- What is financial intelligence?

- What is financial independence?

- How minimalism can help.

- How much is enough for you?

- Find how much you have earned in your life?

- Money is something for which you trade your life energy.

- You pay for money with your time

- Why you should keep track of every cent that goes out of your life.

- How your hourly wage is misguiding you on how much you earn.

- What questions you must ask to transform your life.

- How minimizing spending can save you your life energy

- Where to invest your life energy for financial freedom?

Conclusion

I started the conversation with a well-known phrase about money, “Money is the root of all evil”, and posted a few questions about what money is. After going through a financial crisis personally and coming out of it with the help of these books, I would like to rephrase the saying “The love of money is the root of evil, not the money itself.” (from the book, Your Money or Your Life.)

Money dictates our life, it is our responsibility to understand it. Use the money to live life and not let it run our lives. Life is simple and so is the money.

Financial education will help you understand money, guide you on how to use it, how to invest, where to invest, retire early, live your life, and not worry about money ever.

I have become more aware of my spending habits, I have a clear goal when I wanna be financially independent, and I am not stressed about money as I was earlier.

I recommend these books to everyone. Even if you read just one of these books, you will have more control over your money. Share with us if you have a book that you recommend.

Read my blog post on how to manage your personal finances with cash-flow diagrams here.

1 thought on “Best Books for Financial Education”