Cracking the Code to the Ideal Budget: A Guide to Leveling Up Your Monthly Savings 🏦

Everyone has heard about the concept of living within means, and yet, when it comes to savings, most of us find ourselves in a constant state of bafflement. If you have found yourself wondering how much to stash away each month, you have landed at the right place.

This comprehensive blog post will equip you with practical guidelines on planning a perfect budget that will help you optimize your savings each month without compromising on your present lifestyle. So let’s answer how much to save each month?

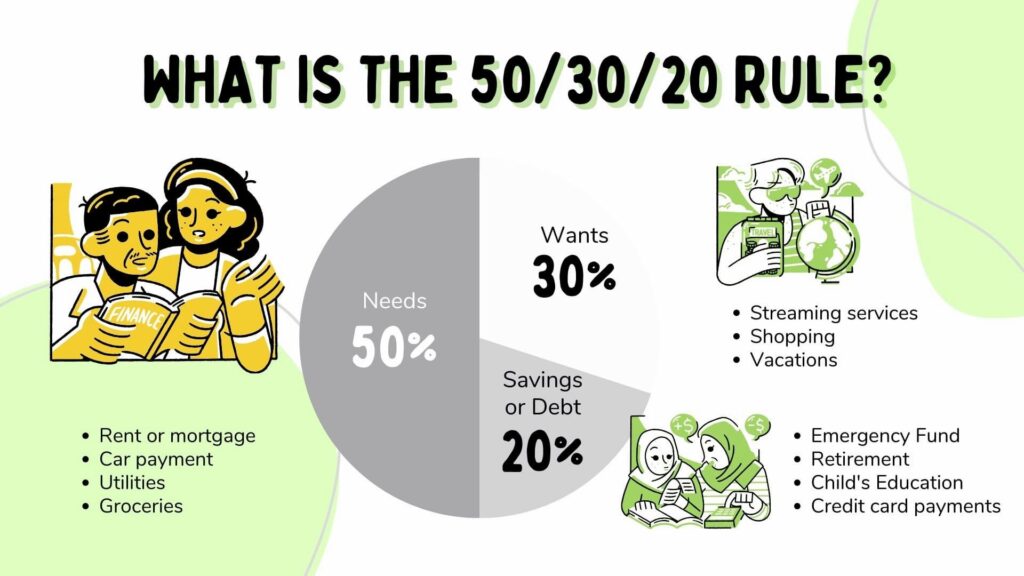

Decoding the 50-20-30 Rule ✅

One of the most straightforward methods of budgeting is popularly known as the 50-20-30 rule. This rule provides a simple structure that tells you where exactly your income should be going.

📌 The Three-Fold Division: How Much to Save Each Month

- 🎯50%: Half your income should cater to essential expenses, like rent or mortgage payments, utilities, groceries, and transportation.

- 🎯20%: Twenty percent should go directly into your savings account or be used to pay off debts.

- 🎯30%: The remaining 30% can be allocated to your personal and recreational expenditures, such as dining out, entertainment, gym memberships, or travel expenses.

In essence, this rule offers a structured and optimal utilitarian view of your earnings, making sure you make the best out of every dollar.

"This grand divide of income – 50% for necessities, 20% for savings, and 30% for personal spendings is flexible to suit individual needs. You can always adjust the percentages based on your financial goals and lifestyle preferences."

- A thought to remember Tweet

Tracking Expenses: Keep an Eye on Every Dollar 📃

Keeping accurate track of your daily expenses is the first step in budgeting. It sheds light on your spending behavior and uncovers potential areas where you could save more.

📌 Using Expense Tracking Apps

Gone are the days of receipt hoarding and manual logging. In today’s era, a myriad of budgeting apps are available at your fingertips. Apps like Mint, YNAB, and PocketGuard help you track your spending, categorize your expenses, and even provide visual representations of your spending patterns.

Setting Financial Goals: Your Beacon to Saving Money 🪜

Understanding your current financial situation is crucial, but it’s only half the battle. Setting clear and specific financial goals can be your guiding beacon, providing the motivation you need to save more.

📌Short Term Goals and Long Term Goals

Your goals may vary from paying off credit card debt in six months to saving for retirement. Breaking these down into short term and long term goals can enhance clarity and make the journey more manageable.

- 🎯Short Term Goals: These may consist of building an emergency fund, purchasing a new gadget, or going on a vacation. They usually span over a couple of months to a few years.

- 🎯Long Term Goals: These include saving for your child’s education, buying a home, or retirement. They span over a decade or more and require consistent savings over prolonged periods.

Remember, the key to successful goal setting is realism. Don’t burden yourself with unachievable goals that will leave you feeling overwhelmed.

Re-evaluating Your Budget: The Art of Staying Adaptable 🔁

A static budget can often lead to frustration and budget fatigue. Adaptability is key to successful budgeting. Thus, it is imperative to regularly re-evaluate your budget as your financial situation changes.

📌 Periodic Reviews and Adjustments

Ensure that you review your budget periodically and make suitable adjustments. Perhaps you received a raise, or there’s a new incoming expense; whatever the changes might be, ensure that your budget accommodates them.

A single approach to budgeting might not work for everyone. Each individual is unique, complete with their own financial goals, habits, and income. The secret to cracking the code of the perfect budget lies in understanding your individual financial landscape and adapting accordingly.

Conclusion🏁

Start your budgeting journey today and achieve financial freedom sooner than you ever imagined.

"Budgets aren't meant to limit your freedom, they are there to grant the freedom over where your hard-earned money goes. Take control of your finances by making your budget personal to you."

- A future you Tweet