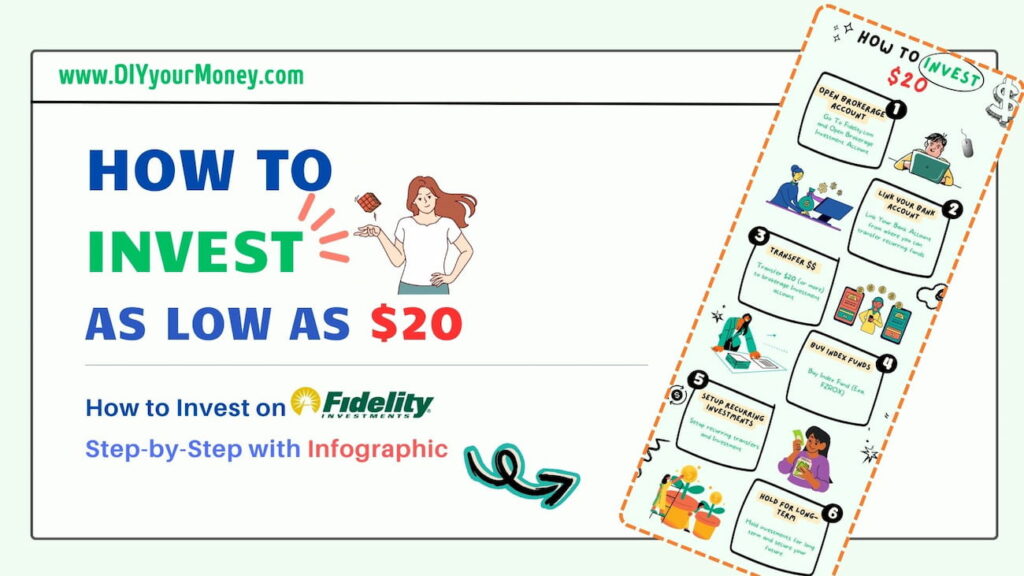

🪜Step-by-step guide on how to invest on Fidelity ❓

$20 is too less of on investment but is it enough to start your financial investing journey. More than enough. Take your $20 and double it in 10 years, yes that’s the compounding magic. Use the investment calculator here, Invest $20 and hold the investments for 10 years with average annual returns of 7% on that investment, you will have almost $40.

Your investment journey is just half an hour away. Follow this step-by-step guide on how to invest on Fidelity.com. I will help you invest those $20 in few clicks on Fidelity.com. And at the end of this guide you will have your first investment account ready and your financial future secured.

The guide is based on Fidelity website but the idea and concepts are same for any other platform.

🗺️Infographic guide

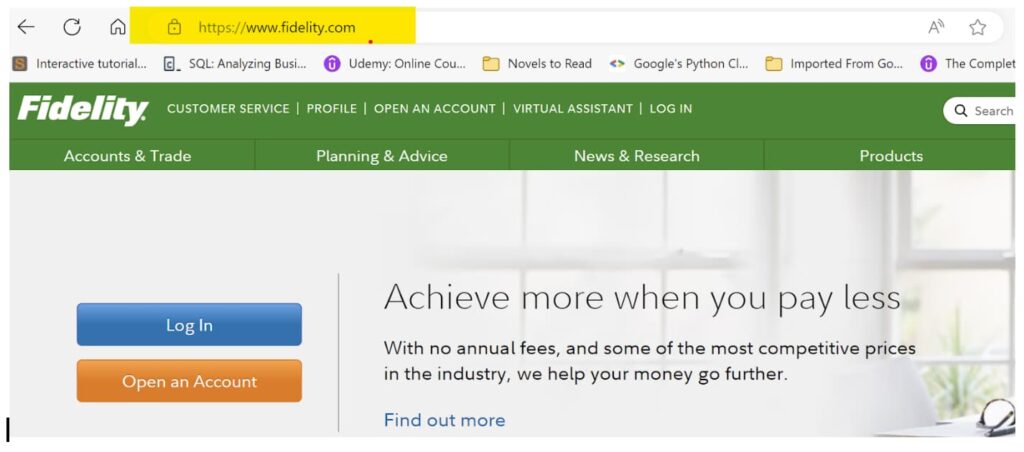

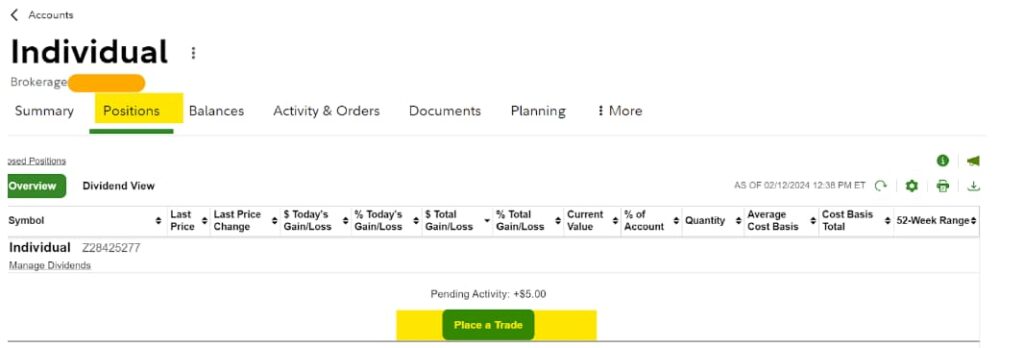

Let’s head On to Fidelity.com, and open a brokerage investment account. Brokerage account is a type of account provided by financial institutes to buy, hold, and sell assets, such as index funds, bonds, stocks. This is the account which will help you grow your investments.

Here’s how to kickstart the process:

- Visit Fidelity’s homepage and find the “Open an Account” button.

- Fill in the necessary personal information to setup your account. This includes deciding whether (individual account) or a duo (joint account).

- Confirm your details and you will have your brokerage investment account ready

- The process is quick and straightforward, requiring basic personal information.

Opening a Fidelity account [Images]

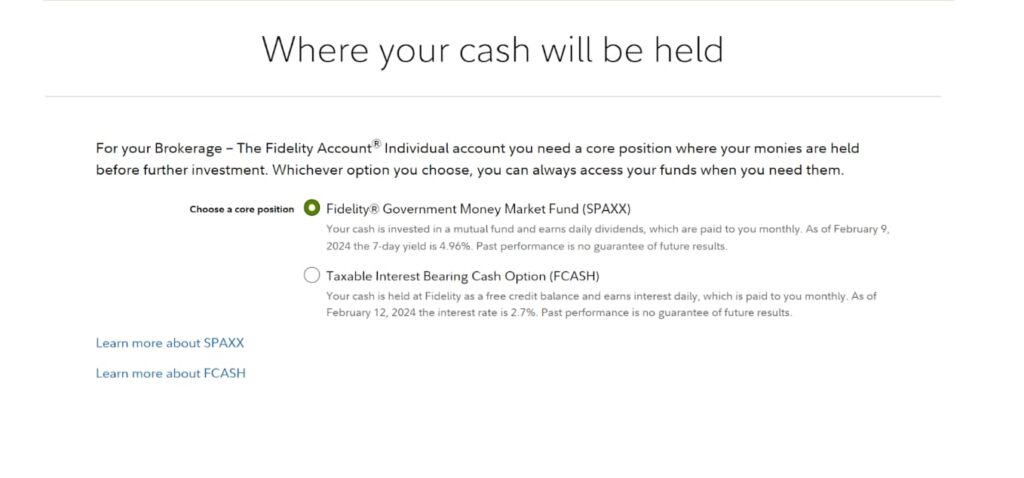

You should also know.

Fidelity offers various types of investment accounts. You should definitely learn about those different types of accounts to manage your investments. For this guide, we have kept it simple and chosen brokerage account.

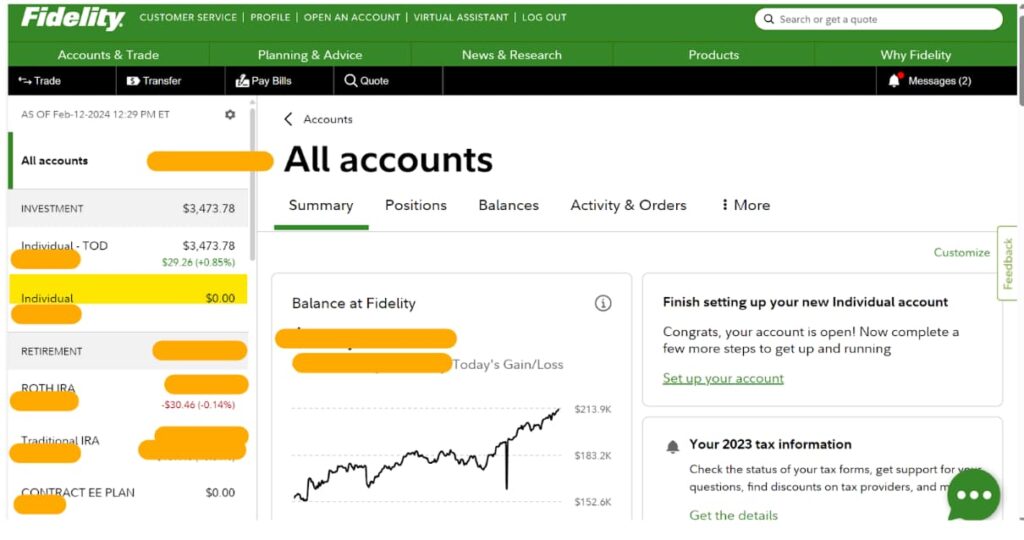

Step 2️⃣: Link Your Bank Account

To start your investments you need money and, you’ll need to link your bank account to your Fidelity account to fund the investments. It’s like any money transfer process, easy and seamless.

The Linking Process

- Navigate to “Setup your Account” on Fidelity.com under your new brokerage account.

- Follow the simple steps to securely connect your bank account.

Step 3️⃣: Transfer as Low as $20 to Start Investing

With as little as $20, you can shape your financial future. If you haven’t invested before and this is the first time you are following this then I feel lucky to be part of your investment journey.

Just Make the Transfer

- Select “Transfer” and let’s start with $20 [If you can invest more then you must]

- Confirm your transaction and your account balance should show it that it’s ready for investment.

Step 4️⃣: Choose your investment, Purchase Index Funds (Example: FZROX)

Time to get excited: Choose your 🥇investment fund.

Index funds provide a diversified basket of stocks, offering broad market exposure and minimizing risk. Fidelity offers several commission-free index funds, like the FZROX Total Market Index Fund, making them perfect for beginners.

The Fidelity ZERO Total Market Index Fund (FZROX) is an excellent starter, offering a diversified investment requiring little to no maintenance.

🛒 Buy Now

- Head over to the “Trade” section.

- Search for FZROX, or another fund of your choosing, and place your buy order.

Step 5️⃣: Set Up Recurring Transfers and Investments

🔂Setting Up Auto-Invest

Easiest way to grow your investments is by automating even small amounts to build your your portfolio and benefit from market fluctuations over time.

🚂Implementing Your Automated System

- Use the “Automatic Investments” feature to establish a recurring investment schedule.

This essentially puts your financial growth on autopilot, allowing you to reap the benefits of consistent investment without trying to guess the market.

Step 6️⃣: Hold Your Investments for Long-Term

Just remember your $20 hold the power to double every 10 years with average market returns. Hold your investments for long term and watch the tree grow.

Check out the graph below and understand what happens if you invest $20 every month and watch your money grow for another 20 years. Sounds like a fun project $20 for 20 years 😉.

You will have $10,000 by just investing $4800 at the end of 20 years. Sounds like good money for a nice gift. This graph shows the power of compounding over time.

Calculate your numbers here: Investment Calculator.

Holding investments for the long term: image of a graph showing long-term investment growth

💰Conclusion: This is just a beginning

Investing $20 wasn’t and won’t be the goal. It is to show the power of simplicity in the era where anyone can start investing in under an hour. You have to start somewhere and take that first step so that you can run and keep running for the long term. Fidelity.com provides a safe playground where you can take that first step.

Happy Investing!

"You don't need a lot of money to start investing. You just need to start."

- Suze Orman Tweet

Bonus Tip: Take advantage of Fidelity’s educational resources and investment tools to further your knowledge and make informed decisions.

What's Next: take action today 🎯

- Best Index Funds: Investing 101: why are index funds such a popular investing option?

- You can invest as much as $20 Start here: https://www.fidelity.com/

- Learn about Index Funds: The Ultimate Guide to Investment with Fidelity 500 Index Fund (FXIAX)

1 thought on “From $20 to Financial Freedom: How to Invest on Fidelity: Step-by-Step with Infographic”